A lot of small and medium-sized businesses are advised to employ one of your family members as the owner (Director) in the company and the risk-taker of the business while your spouse or trust for your family or similar entity holds the assets for the family.

This commercial recommendation is founded in an asset security plan widely used across the nation.

While "trading risk” has been excluded from being susceptible to negative consequences for commercial transactions, the solution doesn't take into account the risk of sole directors to disability or death.

Financial planners may suggest an affordable solution to keyman insurance or something similar. However, this is just one aspect of one's personal vulnerability, which is primarily facing the economic implications.

If you were suddenly to become ill and required serious medial attention, who will act as director(s) of my company?

Imagine a director of the company becomes disabled or dies without a properly-drafted Will and company resolutions. If that happens the business might not run, and their employees might not get paid. This can have catastrophic consequences for their business and consequently, the family.

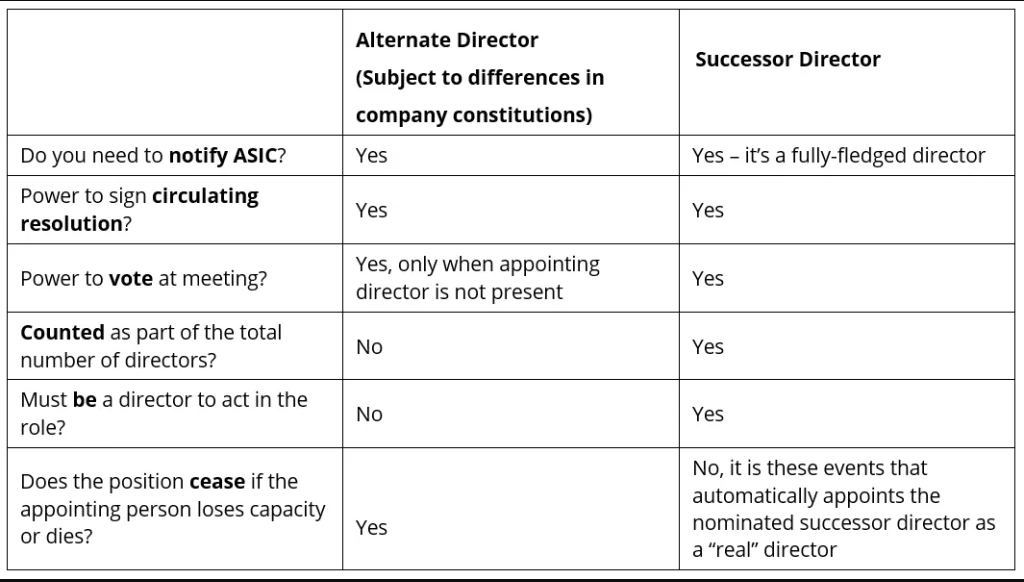

A common solution is to use an alternative director; however, it is only a partial solution.

The term "successor director" refers to an individual named by a director when they are unable to perform their director's duties in the event of divorce, or is disabled or dies to ensure a smooth transition to the director's position.

The appointment of a successor director is essential to ensure Asset Protection and Estate Planning for private and family-owned businesses.

Simply put a Successor Director is a superior option than an alternate director.

If you are the sole director of any company (including corporate trustee), it is prudent to take measures to mitigate against potential risks. Death and incapacity is not something that we like to think about, but it is a reality. Establishing a Successor Director is a key part of risk management in a sole director company.

When you’re ready to get what you want and truly deserve out of your business, we’re here to help

Here are a few ways we can help you

The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice.

A step by step guide to inorganic growth for founders and CEOs. Learn how to structure your acquisition strategy, run the funnel, and use QofE, Financial Due Diligence, and Buy Side Advisory effectively.

.jpg)

As businesses grow, bookkeeping alone stops being enough. Real financial control comes from systems that reflect how the business actually operates, giving founders clarity, confidence, and the ability to make better decisions without constant stress.